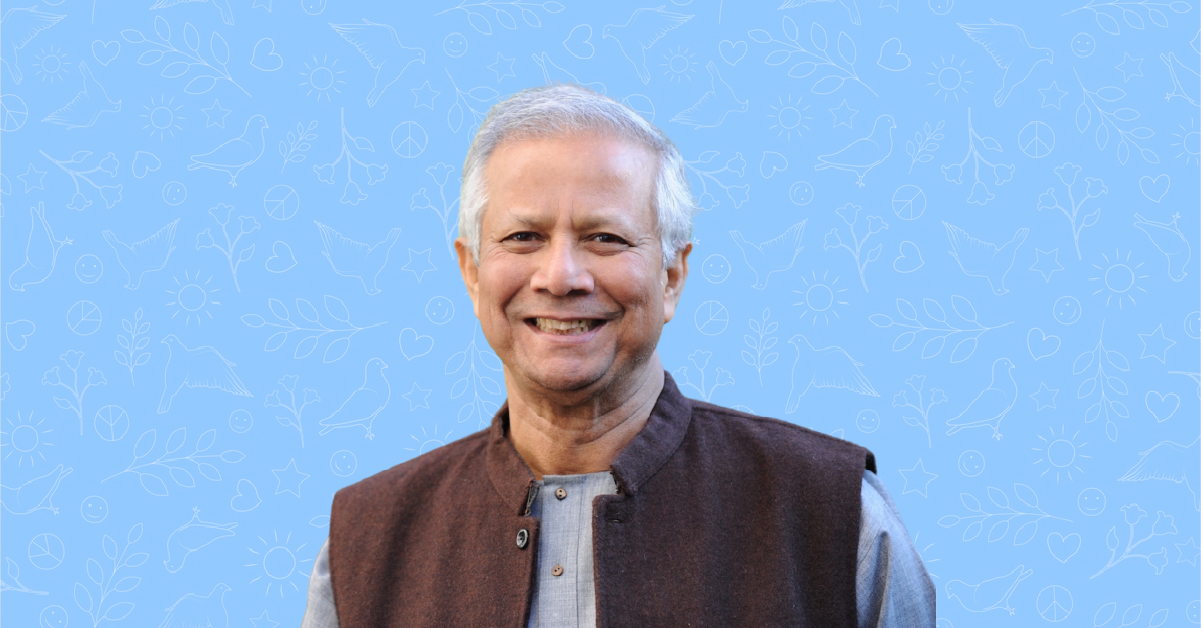

A Humble Beginning

Muhammad Yunus, born in 1940 in Chittagong, Bangladesh, grew up with a deep sense of empathy for those living in poverty. His early life was shaped by a desire to make a difference, particularly as he saw the vast inequalities that plagued his homeland. He pursued higher education abroad, earning a PhD in economics from Vanderbilt University in the U.S., but even as a successful academic, Yunus felt that traditional economic theories were failing to address the needs of the world’s poorest. It was this realization that inspired him to return to Bangladesh in the 1970s with a radical idea.

The Birth of Microcredit

In 1976, Yunus began experimenting with small loans to the rural poor in Jobra, a small village near Chittagong. His initial loan was a modest $27, which he lent to 42 women who made bamboo stools. The results were astonishing. With just a small amount of capital, these women were able to buy materials, produce more stools, sell them at a profit, and pay back the loan—all without the need for collateral. This success ignited the idea for what would become Grameen Bank. In 1983, the bank was officially established with a singular mission: to provide small loans to those who lacked access to traditional financial services.

Transforming the Financial Landscape

Grameen Bank’s business model was groundbreaking. It targeted individuals with no collateral, focusing primarily on women, and it worked. By 2020, Grameen Bank had disbursed over $13 billion in microloans, with a remarkable repayment rate of over 97%. This statistic alone is a testament to the trust and reliability that the bank placed in its borrowers—trust that was rarely afforded to the poor by conventional banks. The average loan size in 2020 was about $250, but the impact was immeasurable for millions of families, helping to lift them out of poverty by creating income-generating opportunities.

Empowering Women at the Core

What truly set Grameen apart was its focus on women. By 2020, over 97% of Grameen’s borrowers were women. Yunus believed that empowering women economically not only uplifted them but also had a broader, more sustainable impact on their families and communities. Studies have shown that when women control income, they tend to spend it on their children’s health, education, and well-being, creating a positive cycle of social development. Through microcredit, Yunus unlocked the economic potential of millions of women, giving them the means to become entrepreneurs and community leaders.

Global Recognition and the Nobel Prize

In 2006, Muhammad Yunus and Grameen Bank were awarded the Nobel Peace Prize for their efforts to alleviate poverty. The Nobel committee described microcredit as “an important liberating force” and recognized its potential for creating lasting peace. By the time Yunus won the Nobel, Grameen Bank had already reached millions of borrowers in Bangladesh and had inspired similar microfinance institutions around the world. His model had been replicated in over 100 countries, and by 2020, the global microfinance industry had more than 140 million clients, many of whom were lifted out of poverty.

An Expanding Legacy

But Yunus’s vision didn’t stop with microloans. Under the umbrella of Grameen, he launched several other social enterprises. Grameen Telecom, for instance, brought telecommunications to rural areas, while Grameen Shakti focused on renewable energy, installing solar panels in homes without electricity. By 2020, Grameen Shakti had installed over 1.9 million solar home systems, revolutionizing energy access in rural Bangladesh. These ventures showcased Yunus’s ability to look beyond financial services and address other pressing needs in his community.

Advisor to Bangladesh’s Interim Government

In 2024, Muhammad Yunus took on a new role as an advisor to Bangladesh’s interim government. His appointment came at a time of political transition following the resignation of Prime Minister Sheikh Hasina amid protests. Yunus’s leadership is expected to help steer the country through this period of uncertainty, particularly by leveraging his expertise in poverty alleviation and economic reform. This move underscores his enduring influence in both economic and political spheres.

Challenges and Controversies

Despite his successes, Yunus has not been without his critics. In 2011, he faced a significant setback when he was ousted from Grameen Bank following a dispute with the Bangladesh government. His critics argued that after more than three decades at the helm, it was time for new leadership. Others believed his removal was politically motivated, a consequence of his growing influence in the country. Despite this, Yunus has remained active on the global stage, advocating for social business and continuing his work to combat poverty.

The Bigger Picture: Social Business and Global Impact

Yunus’s influence extends far beyond microfinance. He has been a vocal advocate for social business—enterprises that are driven by social objectives rather than profit. In his words, “A charity dollar has only one life. A social business dollar can be invested over and over again.” His concept of social business has inspired a global movement, encouraging entrepreneurs to prioritize positive social impact over shareholder returns.

By 2020, Grameen Bank had more than 9 million borrowers, and its microfinance model had been adopted in more than 60 countries, benefiting tens of millions of people worldwide. Yunus’s work also paved the way for greater recognition of microfinance as a crucial tool in global development strategies, particularly in regions struggling with poverty and limited access to financial resources.

Conclusion: An Enduring Legacy

Muhammad Yunus has left an indelible mark on the world. His work has demonstrated that small loans can create big changes, and that empowering individuals—particularly women—has the potential to transform societies. With a Nobel Prize under his belt, billions of dollars in loans distributed, and millions of lives improved, Yunus’s legacy of social innovation and economic empowerment will continue to inspire future generations.