Let’s travel back to the flourishing Mughal Empire under Emperor Akbar’s rule, where one man stood out for his brilliance—not in warfare or politics, but in something just as powerful: finance. That man was Todar Mal, the economic mastermind who completely overhauled the empire’s tax system. This isn’t just a story of calculations and reforms; it’s a tale of ambition, clever strategies, and profound impact on millions of lives.

Early Rise: From Punjab to Akbar’s Court

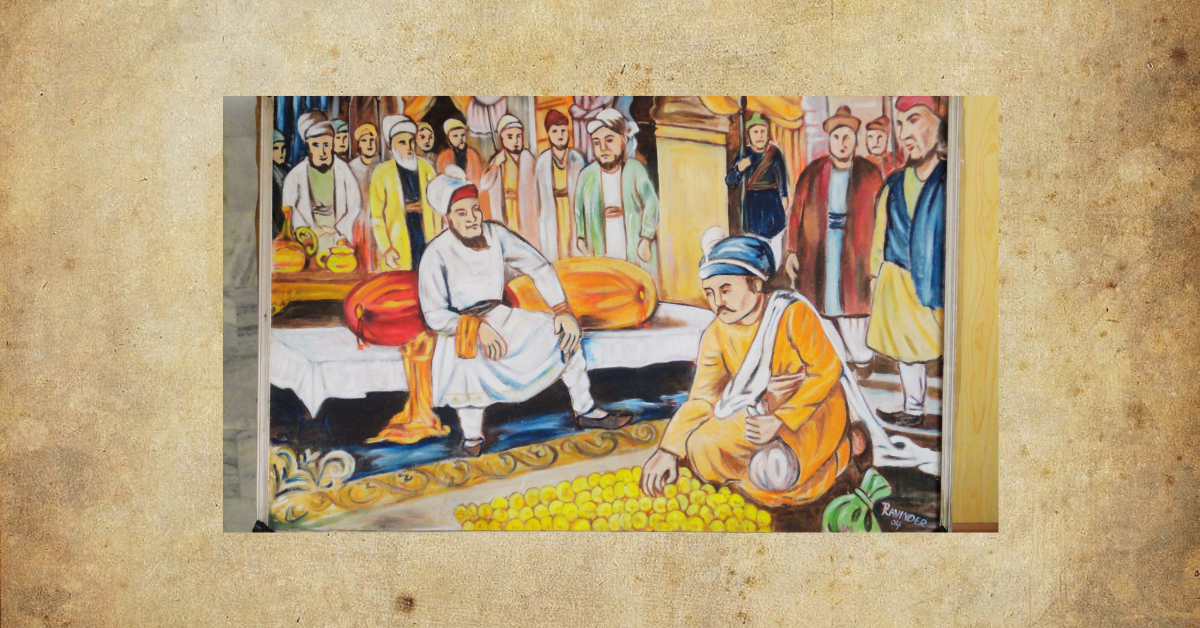

Born in a modest family in Punjab, Todar Mal’s keen intellect and unparalleled administrative skills soon attracted the attention of Mughal nobles. Rising quickly through the ranks, he became Akbar’s Diwan-i-Ashraf, the empire’s chief revenue officer. The Mughal Empire was expanding, but with growth came chaos—especially in how taxes were collected. The empire needed someone who could bring order to its financial system, and Todar Mal was just the man for the job.

The Zabt System: A Revolutionary Tax Overhaul

One of Todar Mal’s most audacious reforms was the introduction of the zabt system, a groundbreaking method of tax collection that changed the way the empire ran its economy. Prior to this, tax collection was often arbitrary, leaving farmers vulnerable to high and unfair taxes. Todar Mal conducted an empire-wide land survey and classified agricultural land based on its fertility. This allowed for more accurate and fair tax rates, ensuring that taxes were proportional to what farmers could actually produce.

This new system wasn’t just about efficiency—it was about fairness. Farmers, who had long been burdened by unpredictable taxes, found the new system more manageable. Todar Mal’s reforms also gave the Mughal bureaucracy a much-needed structure, allowing them to manage the empire’s vast territories with greater precision.

The Fiscal Year and Harvest Alignment

Todar Mal didn’t stop at reforming tax rates. He noticed a deeper flaw in the system: the fiscal calendar didn’t align with the agricultural cycle. Taxes were often collected when farmers had no crops to sell, leading to massive financial strain. Todar Mal smartly synchronized the fiscal year with the farming seasons. This change ensured that taxes were collected after the harvest, when farmers actually had income to pay. The result? A smoother, more humane system that benefitted both the empire and its people.

Bringing Stability to the Empire

Thanks to Todar Mal’s reforms, the Mughal Empire experienced newfound financial stability. His methods were so effective that they continued to influence tax collection in India even after the fall of the Mughal Empire. His innovations lasted through successive rulers, including the British, who adapted his land revenue principles to their colonial administration.

The Human Side: Todar Mal’s Legacy

But Todar Mal’s legacy wasn’t just about numbers and reforms. He genuinely cared for the welfare of farmers and the working class. By creating a system that was not only efficient but also equitable, Todar Mal built trust between the people and the empire. His reforms minimized the risk of rebellion by addressing one of the biggest sources of discontent—unfair taxation.

Impact Through Centuries

Even today, Todar Mal is remembered as one of the greatest financial minds of his era. His vision and reforms transformed how empires approached governance, particularly in financial administration. His zabt system was so well-designed that it laid the groundwork for tax systems in India centuries later, influencing not just how revenue was collected, but also how governments could work for the people.

So, when you think of financial reforms, don’t just think about modern-day economists. Think about Todar Mal, the man who turned the complex Mughal tax system into a well-oiled machine that benefitted both rulers and the ruled. His brilliance, ambition, and genuine care for fairness made him not just a financial genius, but a visionary whose work still resonates today.